JACOBSEN ACCOUNTING ApS

Confused about taxes?

You are not alone

The purpose of this blog is to provide a source of business, tax, and accounting information. English is chosen language to ensure coverage for Danish and non-Danish readers.

Disclaimer of liability

The material and information contained on this website is for general information purposes only. You should not rely upon the material or information on the website as a basis for making any business, legal or any other decisions. Any reliance you place on such material is therefore strictly at your own risk.

Tax on your assets outside Denmark

March, 2021.

Sometimes, I come across clients, who are completely unaware that tax is payable on pensions, savings, investments, and properties located outside Denmark. They would say: No, nobody around me reports that! I have never heard of these taxes! It is against the double taxation agreements!

When you move to Denmark, you may still have properties, pensions, and bank accounts in your home country or elsewhere. After 180 days, you will become fully tax liable to Denmark, and so will your assets. Usually, reporting your assets is not enough; you must also report any capital gains and losses on such assets.

Reporting your assets

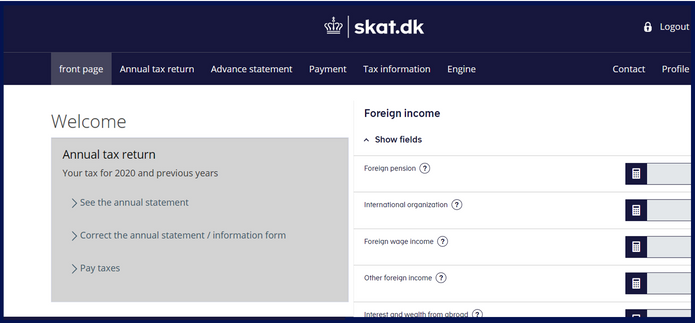

Currently, information about personal assets located in Denmark are automatically reported to the Danish Tax Authority (Skat) by banks, pension funds, and other organisations. All the taxpayer needs to do is to check that the information shown on the annual tax return is correct and then pay any tax due. If personal assets are located outside Denmark, the taxpayer must report them under the foreign income section (Udenlandsk indkomst) of the tax return. For properties and pension savings, you must submit two forms: form 04.053 for property and 49.020 (Declaration L) for pensions and life insurances. There are, however, many legal terms that you may need the help of an accountant to understand and fill out the forms correctly.

Tax on foreign assets

The common tax rule for investments located outside Denmark is that you get tax credit for taxes paid in the country where that investment is located and pay tax on incomes you receive in your country of residence, i.e., Denmark, provided there is a double taxation agreement between Denmark and the foreign country.

Overseas properties will be valued according to one of three methods: recognised property values, valuation using the OECD index, and valuation using the Danish summer house index for properties in non-OECD countries. When you report your foreign properties, you will be taxed in Denmark, and a tax deduction will be given for taxes already paid in the foreign country. If you rent out your properties, then you must report your earning and will also be taxed on such rental business income.

Should your investment be in shares or crypto currencies, you will be taxed on the realisation principle. It means you will be taxed only when you realise your investment, for example, when you sell your shares and realise your gain. Receipts from dividend pay-outs will, however, be taxed in the tax year in which the payment is made. It is most important to keep track of your asset holdings over the years and to keep all relevant documentation available for later reference, should there be any tax enquiries by the authorities.

For your overseas pension investments, if not exempted, the taxation follows a different rule called the mark-to-market principle. Under this rule, your investment will be reported every year, measured at market value, even if you do not sell the stocks, and even if no gain or loss is realised. This rule applies to long term investments such as pensions when the investment is held for a lifetime. The mark-to-market principle also applies to trading companies in the financial sector, when stock trading is the main activity, and the annual income is a combination of realised and unrealised gains or losses.

Usually, income from overseas pension investments is a sum of dividends income, change in market value of the investment, and change in currency exchange rate against the Danish kroner. Considering the market exchange rate volatility lately due to Brexit and the US election, exchange rates of the Pound and the US Dollar will have significant impacts on investment incomes from the two respective countries.

What if…

you have not reported your assets in other countries than Denmark? Do it as quickly as possible. The penalty for not reporting and paying tax ranges from fines to prison sentences of up to 18 months, unless the sentence in the case of a parallel prosecution under other laws is higher. If you want to minimise tax on your assets in foreign countries whilst enjoying your stay in Denmark, then you should convert your investments into other forms of saving.

Earlier blogs

Corona relief: Get your compensations

May, 2020.

You have been working hard to survive. You have been working days and nights to keep your business going and your customers happy. Now you should reach out for the government’s helping hand - to get your compensations.

Corona relief: Extension of tax payments

March, 2020.

At least there is something positive coming out of the corona pandemic: the economic incentives, which has been hurriedly passed by the government on the 17th of March 2020.

Sales the Danish way

January, 2020.

We are in the middle of the winter sale season. It is a good time for the consumers to stock their wardrobes and a good opportunity for the retailers to cash in and get rid of stocks. How do you manage sales like a local? You need to know how to run sales the Danish way.